CILO CYBIN HOLDINGS IPO WEBINAR

We are excited to invite you to an exclusive interactive webinar where our CEO, Gabriel Theron, provides insights on the much-anticipated 2024 Initial Public Offering (IPO). This informative session promises to be enlightening for investors, stakeholders, and anyone interested in understanding the intricacies of our company's next strategic move. Watch the full webinar below.

IPO ANNOUNCEMENT

I am pleased to share a significant update with you. Cilo Cybin Holdings Ltd, a Special Purpose Acquisition Company (SPAC) aiming to operate at the intersection of biotechnology, pharmaceuticals, and AI technology, has received our prospectus's approval from the CIPC in South Africa.

Though our journey started slower than anticipated, we are now on track. With the backing of ALPS Global Berhard from Malaysia, who provided $3 million in funding, we are excited to announce the opening of our IPO to the public. This is a unique opportunity to invest in a company pioneering advancements in biotechnology and pharmaceuticals.

Cilo Cybin Holdings Ltd's first target company, Cilo Cybin Pharmaceutical, is one of the leading cannabis companies in South Africa that specializes in the cultivation and manufacturing of medicines under GMP in the Medical Cannabis sector. Cilo Cybin Pharmaceutical is also set to commence clinical trials on Cannabis products with ALPS Global in 2024.

Also available on these Platforms

Join the excitement and share it across your social platforms

Who is Alps Global?

ALPS (www.alps-holdings.com) and Dr Tham Seng Kong, the ALPS founder and CEO, have each invested USD1.5million in Cilo Cybin. The USD3million was converted into R54 648 279 and paid into the Cilo Cybin Escrow Account managed by FNB (“all- inclusive the “Alps Subscription”). After implementation of the offer to the public (“IPO”) as set out in more detail in the Cilo Cybin Prospectus dated 26 February 2024 (the “Prospectus”) ALPS and Dr Tham will in aggregate own 81% of the Cilo Cybin shares.

ALPS, a Malaysian based company, focus on precision medicine and preventative medicine giving a second chance by enabling accessibility and affordability to all. ALPS is a market leader in DNA – Whole Genome Sequencing that forms the basis of preventative medicine and cell therapy that include regenerative medicine, specialised cells (induced pluripotent stem cells) iPSCs and immunotherapy with a cancer treatment focus. Technologies used includes genomics DNA, mRNA, and cellular therapy.

ALPS operates and its market penetration strategy is focused on the South East Asia market, with a GDP of US$9.7 trillion that includes countries such as Singapore, Malaysia, Indonesia, Philippines, Thailand, etc. ALPS is in the process of listing on Nasdaq and have announced the take-over of a Nasdaq listed SPAC named Globalink Investment in a deal that values ALPS at US$1.6billion. The merger is expected to close in the second quarter of 2024 and the combined company will be named “Alps Life Sciences Inc”. The proceeds from the ALPS Nasdaq listing will be used to fund capex and future global growth.

The stated intention is to use Cilo Cybin as the ALPS patented biotech drugs platform.

HISTORY

At Cilo Cybin Holdings, our journey has been characterized by perseverance, adaptability, and a commitment to our vision. Below is a brief history of our progress:

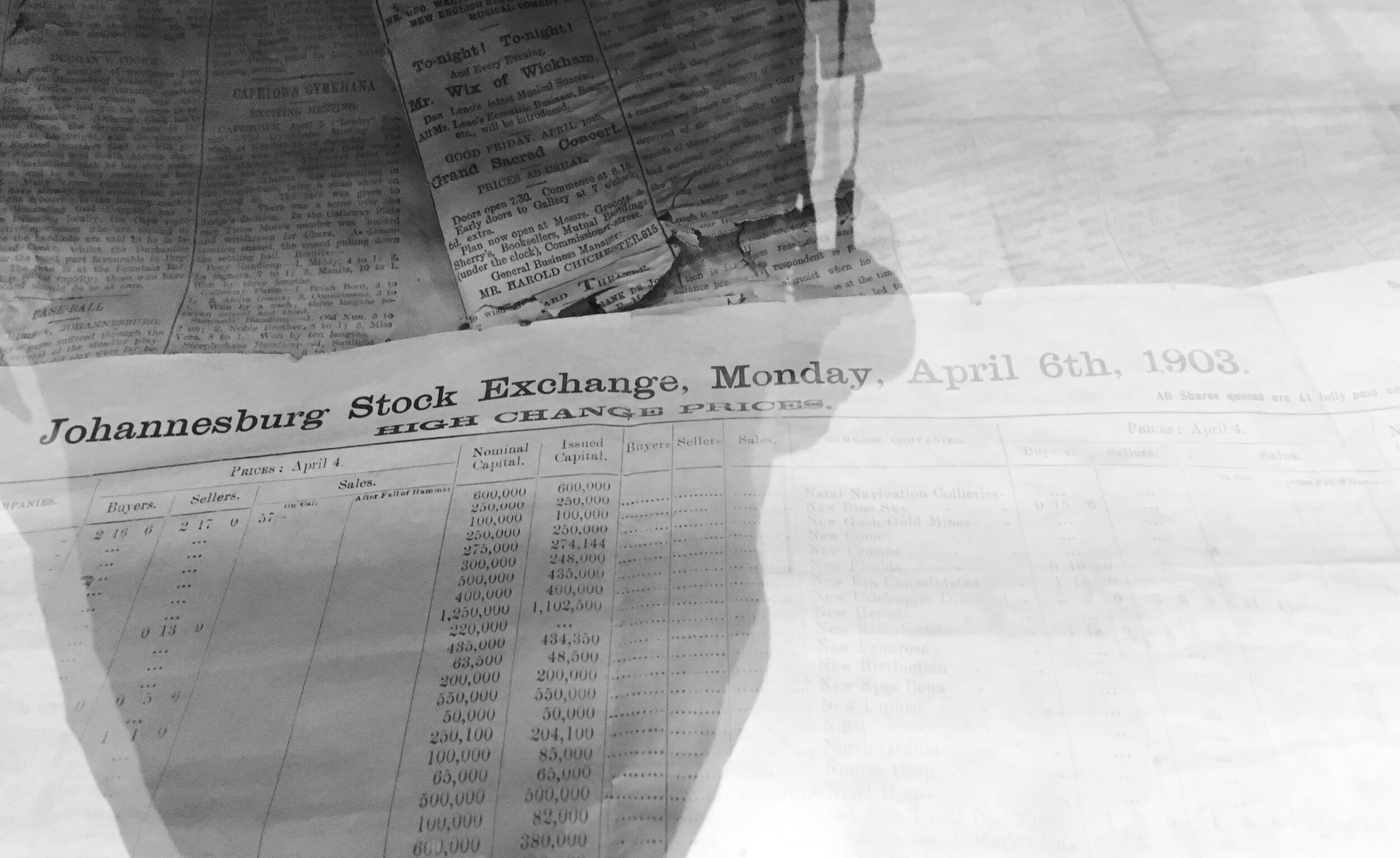

End of 2022: Our ambitions led us to the initiation of an Initial Public Offering (IPO) process with the goal of listing on the Johannesburg Stock Exchange (JSE). During this pivotal time, our roadshow attracted the interest of ALPS Global, a prominent Malaysian pharmaceutical company, indicating a synergy of vision and opportunity.

IPO Results: Despite the overwhelming support from almost 2000 enthusiastic investors, raising just over R20 million rand, our endeavor faced a challenge. The amount raised fell short of the qualification threshold for a JSE listing.

Decision Time: A day after the close of our listing, we sat down with ALPS Global. They expressed an interest in further investing, proposing an extension of the listing period. Given the tight schedule, the approaching year-end in November, and potential delays in document processing from the Malaysian side, we foresaw risks. We prioritized the interests of our investors and the reputation of Cilo Cybin Holdings. We took the tough decision to announce the IPO attempt as unsuccessful and started the refund process. Our focus shifted to forging a robust agreement with ALPS Global.

A New Dawn in 2023: Our patience and perseverance paid off. By September 2023, we proudly signed an investment contract with ALPS Global. This partnership aims to back Cilo Cybin Holdings in a renewed attempt to list on the JSE, again as a SPAC (Special Purpose Acquisition Company).

Our Next Step: The vision is clear - list the SPAC on the ALT-X of the JSE, and subsequently transition to the JSE main board post the acquisition of our target company. To realize this, we're looking forward to presenting an Investment Prospectus to the public. Our goal is to raise a 10% public spread, ensuring our qualification for a JSE ALT-X listing. We project this initiative to take place in the upcoming October or early November 2023.

Our story, filled with challenges and triumphs, continues to unfold. We're deeply thankful for the unwavering trust and support of our stakeholders, and eagerly anticipate the exciting milestones that lie ahead. Join us in our pursuit of excellence and be a part of our growing legacy. You can submit your details below in order to receive updates on the investment opportunities over the next couple of weeks.

GENERAL

FAQs

-

Cilo Cybin Holdings Ltd is only making 10% of the total equity available, totaling: R7,101,791 at R1 per share.

-

The minimum investment amount is R1,000.

-

As soon as the R7,101,791 target is reached, the Board will close the investment offer to the public.

-

Yes, as long as you invest a minimum of R1,000 you qualify to invest. You do not need a trading account to do the initial investment. Once we close the offer to the public, JSE Investor Services will assist investors that does not have a CSDP (Trading account) to open one.

-

Your funds are deposited into an FNB Escrow account which means that it is safe and can only be used as per the breakdown in the prospectus.

-

It is highly unlikely that the fundraising will fail as the minimum investment needed to list on the JSE AltX has already been met. However, in the unlikely event that it fails, investors will be refunded their investment.

PROSPECTUS

FAQs

-

You can participate in the IPO by completing the application form on pages 141 to 145 of the prospectus, making payment, and emailing the completed application form to ipo@cilocybin.com. Alternatively click on this link to take you to the investor page containing all important documents and information on how to participate.

-

The minimum amount for purchasing shares is R1,000.

-

The maximum amount for purchasing shares is R7,000,000.

-

You will hear back either when the escrow account balance reaches R7,101,791 or by April 12, 2024, whichever comes earlier.

-

- Not applicable.

-

Yes, once the shares are listed.

-

You can track the performance of your shares on the listed platform's daily VWAP information

-

You have full control over your shares.

-

The shares will be held in your name if purchased personally, or the name of the entity(trust/company etc) that purchases the shares.

-

Yes, if you use a broker/CSDP of your bank and once your shares are credited on a "delivery free of payment basis" on the day of listing against your account.

-

No, your shares cannot be sold without your approval.

-

You will receive a share statement between the close of the IPO on April 12, 2024, and the listing date. Your shares will be credited in electronic format on the listing date. You can sell your shares through your broker after they are listed.

SPAC

FAQs

-

A SPAC is a Special Purpose Acquisition Company. It is a cash shell that holds a minimum of R50 million in cash on the listing date. Viable assets are acquired after listing, unlike in a traditional IPO where an operational business is listed.

-

Risks include the possibility of the SPAC not de-SPACing(is there a definition available for this word?), and management misusing funds. Investors may receive a reduced capital amount if the SPAC is liquidated after 36 months.

-

Yes, your broker can make the application on your behalf, as outlined in the prospectus.

-

There are no warrants associated with this offering.

-

Yes, once listed, it is protected by JSE regulation, and before listing, it is protected by the memorandum of incorporation and provisions of the registered prospectus.